UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

ScheduleSCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:No._)

Filed by the Registrant ☒ | ||

Filed by a party other than the Registrant ☐ | ||

Check the appropriate box: | ||

☒ Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| ☐ Definitive Proxy Statement | ||

☐ | Definitive Additional Materials | ||

☐ | Soliciting Material under | ||

FLUENT, INC.

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ||||||||

☒ No fee required |

☐ | Fee paid previously with preliminary | ||||||||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules | ||||||||

FLUENT, INC.

300 Vesey Street, 9th Floor

New York, New York 10282

| 300 Vesey Street, 9th Floor |

| New York, NY 10282 |

| (646) 669-7272 |

NOTICE OF ANNUALSPECIAL MEETING OF STOCKHOLDERS

To be held on June 7, 2023March 18, 2024

To our Stockholders:

The Annual Meeting ofDear Stockholders of Fluent, Inc.:

You are invited to attend a special meeting (the “Meeting”) of stockholders of Fluent, Inc., a Delaware corporation (“Fluent,” “we,” “us,” “our,” or the “Company”) will, to be held on Wednesday, June 7, 2023,Monday, March 18, 2024 at 11:00 a.m. Eastern Time. The Annual Meeting will be completelyconvened and conducted in a virtual. You may meeting format. Stockholders will not be able to attend the meeting,Meeting in person. The accompanying proxy statement includes instructions on how to attend the Meeting and how to vote and submit questions,questions.

At the Meeting, our stockholders will consider and vote your shares electronically during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/FLNT2023. At the meeting you will be asked to consider and to vote onupon the following proposals:items:

|

|

|

| |

|

| |

|

|

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” BOTH PROPOSALS.

The Boardrecord date for the Meeting is February 12, 2024. Only stockholders of Directors has fixedrecord at the close of business on May 5, 2023, as the record date for the determination of stockholdersare entitled to notice of and to vote at the annual meeting.Meeting, or any adjournment or postponement thereof.

The enclosedYou are cordially invited to participate in the Meeting. Please review the proxy statement containsaccompanying this notice for more complete information pertaining toregarding the matters to be voted on at the annual meeting. A copy ofMeeting. Whether or not you expect to attend the Company’s Annual Report on Form 10-K forMeeting, please complete, date, sign and return the fiscal year ended December 31, 2022, is being mailed with thisenclosed proxy statement.card or submit your proxy through the Internet or by telephone as promptly as possible to ensure your shares will be represented at the Meeting.

New York, New York | By order of the Board of Directors, |

|

|

| Ryan Schulke | |

| Chairman of the Board and |

New York, New York

May 1, 2023Important Notice Regarding the Availability of Proxy Materials for the Special Meeting

YOU ARE REQUESTED, REGARDLESS OF THE NUMBER OF SHARES OWNED, TO SIGN AND

DATE THE ENCLOSED PROXY CARD AND TO MAIL IT PROMPTLY, OR VOTE AS OTHERWISE SET

FORTH IN THE ACCOMPANYING PROXY.The notice of special meeting and the proxy statement and form of proxy card are available at https://investors.fluentco.com/financial-information/sec-filings.

| ||

| ||

FLUENT, INC.

300 Vesey Street, 9th Floor

New York, New York 10282

PROXY STATEMENT

Annual Meeting of StockholdersSPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON March 18, 2024

To be held on June 7, 2023

QUESTIONS AND ANSWERS ABOUT THIS PROXY STATEMENT, THE SPECIAL MEETING AND VOTING

GeneralWhy did I receive these proxy materials?

We are providing these proxy materials in connection with the solicitation by the Boardboard of Directorsdirectors (the “Board” or “Board of Directors”) of Fluent, Inc. (referred to as “we,” “our,” “us,” the “Company,” the “Corporation” or “Fluent” in this proxy statement), of the proxies to be voted at our 2023 Annual Meetinga special meeting (the “Meeting”) of Stockholders (the “Meeting” or “Annual Meeting”)stockholders scheduled to be held at 11:00 a.m. Eastern Time on March 18, 2024 and at any and all postponementsadjournment or adjournmentspostponement thereof. Before or during the Meeting, stockholders will act upon the proposals described in this proxy statement.

The notice of the Meeting, will be held on Wednesday, June 7, 2023, at 11:00 a.m., Eastern Time. The Meeting will be held virtually via live webcast, which you may attend by visiting www.virtualshareholdermeeting.com/FLNT2023. Thisthis proxy statement and the enclosed form of proxy card are first being sent or made available to stockholders on or about May[•], 2024.

Who can vote at the Meeting?

Only our stockholders of record at the close of business on February 12, 2024, the record date for the Meeting, or their legal proxy holders, are entitled to vote at the Meeting. There were [•] shares of our common stock outstanding and entitled to vote on the record date. Our common stock is our only class of outstanding stock. Each share of common stock is entitled to one vote on each matter properly brought before the Meeting. A complete list of stockholders entitled to vote at the Meeting will be available at our offices located at 300 Vesey Street, 9 2023. In this proxy statement, Fluent, Inc. is referredth Floor, New York, NY 10282 for any purpose germane to the Meeting, during ordinary business hours, for a period of ten days prior to the Meeting. The list will also be available for examination by stockholders during the Meeting within the virtual meeting platform, which may be accessed as “Fluent,”described below under the “Company,heading “How may I participate in the Meeting?” “we,” “our,” or “us.”. If you would like to inspect the list prior to the Meeting, please call Daniel J. Barsky, General Counsel and Corporate Secretary, at (646) 669-7272 to arrange a visit to our offices.

How may I participate in the Meeting?

The Meeting will be a completely virtual meeting conducted asvia live audio webcast. We believe this technology provides expanded access, improved communication and cost savings for our stockholders. Hosting a virtual meeting of stockholders by means of a live webcast. We believe that hosting our Annual Meeting virtually, as we did in 2022, would be in the best interests of our stockholders and employees and enable improved communication and greaterenables increased stockholder attendance and participation from any location. There will notlocation around the world.

To participate in the Meeting, go to www.virtualshareholdermeeting.com/FLNT2024SM. Online check-in may begin 15 minutes before the Meeting is scheduled to start. We encourage you to access the Meeting early so that any technical difficulties may be addressed before the Meeting begins. You should ensure you have a physical meeting locationstrong Internet connection wherever you intend to participate in the Meeting. Please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and you will not be able to attendtelephone or similar companies.

Stockholders of record: Shares registered directly in person.your name

If, you are a registered stockholder or beneficial owner of common stock holding shares at the close of business on the record date, your shares were registered directly in your name with the Company’s transfer agent, then you are a stockholder of record for purposes of the Meeting and you may attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/FLNT2023 FLNT2024SMand logging in by entering the 16-digit control number found on your proxy card voter instruction form, or otheron the instructions that accompanied the proxy materials provided to you, as applicable. Once you are logged into the Meeting using your 16-digit control number, you will be able to submit a question at any time during the Meeting by following the instructions provided in the Meeting portal. The chair of the Meeting has broad authority to conduct the Meeting in an orderly manner, including establishing rules of conduct.

If you have lost your 16-digit control number or are not a registered stockholder entitled to vote at the Meeting, you will be able to attend the Meeting by visiting www.virtualshareholdermeeting.com/FLNT2023 FLNT2024SMand registering as a guest. If you enter the Meeting as a guest, you will not be able to vote your shares or submit questions during the Meeting.

We invite you to virtually attendBeneficial owners: Shares registered in the Annual Meeting and request that you vote on the proposals described in this proxy statement. However, you do not need to attend the virtual Meeting to vote your shares. Instead, you may vote by proxy, via the Internet,name of a broker, bank or by mail by following the instructions provided on the proxy card. We encourage you to vote before the Annual Meeting.other nominee

Purpose of the Annual Meeting

At the Meeting, our stockholders will consider and vote upon the following matters:

|

| |

|

| |

|

| |

|

|

Outstanding Securities and Voting Rights

Only holders of record of the Company’s common stockIf, at the close of business on May 5, 2023, the record date, your shares were not held in your name, but rather in an account at a broker, bank, or other nominee, then you are the beneficial owner of those shares and those shares are considered to be held in “street name.” The proxy materials for the Meeting are entitledbeing forwarded to noticeyou by the broker, bank or other nominee holding your shares. The organization holding your shares is considered to be the stockholder of andrecord for purposes of voting on the proposals being submitted to voteour stockholders at the Meeting. As of May 5, 2023, we expecta beneficial owner, you have the right to have approximately 81,036,163shares of common stock outstanding. Each share of common stock is entitled to one vote at the Meeting. If your shares are registered in your name, you are a stockholder of record. If your shares are held in the name ofdirect your broker, bank or another holder of record, these shares are held in “street name.”

The holders of a majority of the issued and outstanding shares of common stock present at the Meeting, either in person or by proxy, and entitledother nominee regarding how to vote constitute a quorum for the transaction of business. Abstentions will be includedshares in determining the presence of a quorum atyour account. You are also invited to virtually attend the Meeting.

If However, if your shares are held in street name, you mustmay not vote your shares at the Meeting or submit questions during the Meeting unless you first request and obtain a valid legal proxy from your broker, bank or other nominee. Please see the discussion below under the heading, “How do I vote?” for information on obtaining a valid legal proxy for the Meeting.

What proposals will be submitted to the stockholders for a vote?

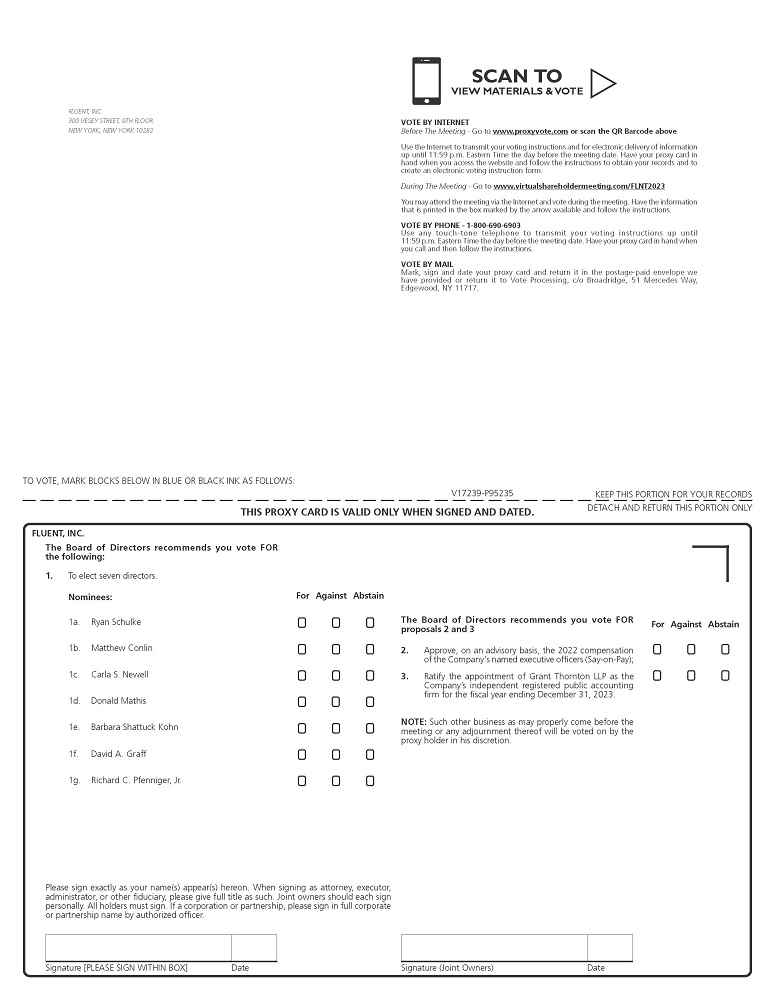

There are two matters scheduled for a vote:

1. | To approve a proposal to give the Board the authority, at its discretion, to file a certificate of amendment to our certificate of incorporation to effect a reverse split of our issued common stock at a ratio that is not less than 1-for-2 and not greater than 1-for-15, without reducing the authorized number of shares of our common stock, with the exact ratio to be selected by the Board in its discretion and to be effected, if at all, in the sole discretion of the Board at any time following stockholder approval of the amendment to our certificate of incorporation and before March 18, 2025 without further approval or authorization of our stockholders. We refer to this proposal as the “Reverse Stock Split Proposal.” |

2. | To approve the adjournment of the Meeting, if necessary or advisable, to solicit additional proxies in favor of the Reverse Stock Split Proposal if there are not sufficient votes to approve such proposal. We refer to this proposal as the “Adjournment Proposal.” |

Why is the Reverse Stock Split Proposal important?

The primary goal of the reverse stock split, if implemented, is to increase the price per share of our common stock to regain compliance with The Nasdaq Capital Market’s continued listing requirements relating to maintaining a minimum bid price of $1.00 per share. If we do not demonstrate compliance with The Nasdaq Capital Market’s minimum bid price requirements by April 29, 2024, we will receive written notification from the staff of The Nasdaq Stock Market, LLC that our common stock will be delisted. The Board believes it is in the best interest of the Company and our stockholders to maintain the listing of our common stock on The Nasdaq Capital Market. For more information on the reasons for the Reverse Stock Split Proposal and its general effect, if implemented, please refer to the section of this proxy statement entitled “PROPOSAL NO. 1 THE REVERSE STOCK SPLIT PROPOSAL.”

How does the Board recommend that I vote on the proposals?

The Board recommends that you vote as follows:

● | “FOR” the Reverse Stock Split Proposal; and |

● | “FOR” the Adjournment Proposal. |

How do I vote?

All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or voting instruction form, as applicable, or as instructed via the Internet or telephone. You may specify whether your shares should be voted “FOR” or “AGAINST,” or you may specify that your shares should “ABSTAIN” from voting with respect to each proposal. Voting by proxy will not affect your right to attend the Meeting.

The procedures for voting are as follows:

Stockholders of record: Shares registered directly in your name.

If you are a stockholder of record, you may vote online during the Meeting or you may vote by proxy using the enclosed proxy card or through the Internet or over the telephone. Whether or not you plan to participate in the Meeting, we urge you to vote by proxy to ensure your vote is counted. Even if you vote by proxy, you may still attend the Meeting and vote online during meeting, if you choose.

● | During the Meeting: To vote online during the Meeting, follow the instructions above under the heading “How do I participate in the Meeting?” to access the Meeting and then follow the instructions available in the Meeting platform during the meeting. |

● | By Mail: To vote using the proxy card, please complete, sign and date the proxy card and return it in the provided prepaid envelope. If we receive your signed proxy card before the Meeting, we will vote your shares as instructed on the proxy card. |

● | By Internet: Go to https://www.proxyvote.com or scan the QR code provided on your proxy card and follow the instructions. Please have your proxy card handy when you access the website. If you vote via the Internet, you do not need to return your proxy card. |

● | By Telephone: Call the toll-free telephone number on your proxy card. Please have your proxy card handy when you call. Easy-to-follow voice prompts will allow you to vote your shares and confirm that your instructions have been properly recorded. If you vote by telephone, you do not need to return your proxy card. |

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day until 11:59 p.m. Eastern Time on March 17, 2024. After that, telephone and Internet voting will be closed, and if you want to vote your shares, you will either need to ensure that your proxy card is received before voting begins at the Meeting or attend the Meeting and vote your shares online during the meeting.

Beneficial owners: Shares registered in the name of a broker, bank or other nominee.

If you are the beneficial owner of shares of our common stock, and you should have received this proxy statement and the accompanying notice of the Meeting by mail or e-mail from the broker, bank, or other nominee holding your shares, along with information on how to submit your voting instructions. As a beneficial owner, you have the right to instruct the organization who holdsholding your shares how to vote your shares. Follow the voting instructions provided by your broker, bank, or other nominee to ensure your vote is counted. To vote online during the Meeting, you must first obtain a valid legal proxy from your broker, bank or other nominee. Follow the instructions from your broker, bank, or other nominee provided with these proxy materials, or contact your broker, bank, or other nominee to request a proxy form well in advance of the Meeting.

What happens if I do not vote?

Stockholders of record: Shares registered directly in your name.

If you signare a stockholder of record and do not vote by completing your proxy card, butor by telephone, through the Internet, or by virtually attending the Meeting and voting during the Meeting, your shares will not be voted.

Beneficial owners: Shares registered in the name of a broker, bank or other nominee.

If you are a beneficial owner and do not provide instructions on howinstruct your broker, should vote on “routine” proposals, your broker maybank, or other nominee how to vote your shares, as recommended by the Board.question of whether your broker, bank or other nominee will still be able to vote your shares depends on whether a particular proposal is considered a “routine” or “non-routine” matter under the rules of the New York Stock Exchange applicable to securities intermediaries, even though we are a Nasdaq-listed company. If you do not provide voting instructions, your shares will not be voted on any proposal considered a “non-routine” proposals. Thismatter because brokers, banks and other agents lack discretionary authority to vote uninstructed shares on non-routine matters. The absence of a vote on non-routine matters is called a “broker non-vote.” On the other hand, brokers, banks and other nominees may use their discretion to vote uninstructed shares on matters consider to be “routine.”

ForWe expect the Reverse Stock Split Proposal 1 (election of directors), aand the Adjournment Proposal to be considered “routine” matters under New York Stock Exchange rules. Accordingly, we expect the broker, bank and other nominee for director will be elected to the Board if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. Proposal 2 (Say-on-Pay), and Proposal 3 (auditor ratification) will be determined by of a majority of votes cast affirmatively or negatively at the Meeting by the holders entitled to vote. Abstentions and broker non-votesholding your shares will have no effectdiscretionary voting authority to vote your shares on the proposals.

PROPOSALS FOR STOCKHOLDER VOTE AND APPROVAL REQUIREMENTS

Management is presenting three proposals forReverse Stock Split Proposal and the Adjournment Proposal even if that organization does not receive voting instructions from you. However, certain organizations may elect not to vote shares without an instruction from the beneficial holder even if they have discretionary authority to do so. So, if you are a stockholder vote. Stockholders are entitled to one vote for each share of stock heldbeneficial holder, please follow the instructions provided by such stockholder which has voting power upon the matter in question. Abstentions and broker non-votes (shares held in “street name” by ayour broker, bank or other nominee that does not have authority, either express or discretionary,to instruct the organization as to how you wish to vote on a non-routine matter, such as Proposals 1 and 2) will not be taken into account in determining the outcome of the vote, consistent with Delaware law and the proxy rules of the U.S. Securities and Exchange Commission (“SEC”).your shares.

PROPOSAL 1.ELECTION OF DIRECTORSMay I revoke a previously submitted proxy or otherwise change my vote?

THE BOARD IS SUBJECT TO ANNUAL ELECTION BY THE STOCKHOLDERS. THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE FOLLOWING SEVEN DIRECTOR NOMINEES:

|

|

|

|

|

|

|

Yes. You can find information about the director nominees, Fluent’s Board of Directors, its committees, and other related matters in the section entitled, “Proposal 1 – Election of Directors” of thismay revoke your proxy statement.

Delaware law and Fluent’s Amended and Restated By-Laws (“By-Laws”) govern theor change your vote on Proposal 1, on which you may:

|

|

|

|

|

|

|

|

Under our By-Laws and assuming a quorum is present, a director nominee in an uncontested election must be elected by a majority of votes cast. A majority exists when the number of votes cast “FOR” a director nominee exceeds the number of votes cast “against” the director nominee. A director nominee who fails to receive a majority of votes cast in an uncontested election is required to tender his or her resignation from the Board of Directors under the terms of our Director Resignation Policy adopted in 2019. In such an event, the Corporate Governance and Nominating Committee will meet to consider the tendered resignation and make a recommendation to the Board concerning the action, if any, to be taken with respect to the resignation. Abstentions and broker non-votes will not be taken into account.

PROPOSAL 2.APPROVAL, ON AN ADVISORY BASIS, OF THE 2022 COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE 2022 COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS DISCLOSED IN THIS PROXY STATEMENT.

You can find information about the compensation of our named executive officers in the section entitled, “Executive Compensation” and about Proposal 2 in the section entitled, “Proposal 2 – Non-Binding Advisory Vote Say-On-Pay” of this proxy statement.

Delaware law and Fluent’s By-Laws govern the vote on Proposal 2, on which you may:

|

|

|

|

|

|

Assuming a quorum is present, Proposal 2 will pass if approved by an affirmative vote of a majority of the votes cast at the Annual Meeting by the holders entitled to vote. Abstentions and broker non-votes will not be taken into account in determining whether the proposal has received the requisite number of affirmative votes, consistent with Delaware law and the SEC’s proxy rules.

PROPOSAL 3.RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF GRANT THORNTON LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023.

You can find information about Fluent’s relationship with Grant Thornton LLP in the section entitled, “Proposal 3 – Ratification of the Appointment of Grant Thornton LLP as our Independent Registered Public Accounting Firm for Fiscal Year 2023” of this proxy statement. Delaware law and Fluent’s By-Laws govern the vote on Proposal 3, on which you may:

|

|

|

|

|

|

Assuming a quorum is present, Proposal 3 will pass if it receives an affirmative vote of a majority of the votes cast at the Annual Meeting by the holders entitled to vote. Abstentions will not be taken into account in determining whether the proposal has received the requisite number of affirmative votes, consistent with Delaware law and the SEC’s proxy rules. Proposal 3 is considered a “routine” matter on which brokers may cast a vote.

OTHER MATTERS TO COME BEFORE THE ANNUAL MEETING

The Board of Directors is unaware of any other business to be presented for a vote at the Annual Meeting. If any other matters are properly presented for a vote, the individuals named as proxies will have discretionary authority to vote on such matters according to their best judgment to the extent permitted by applicable law and Nasdaq Stock Market (“Nasdaq”) and SEC rules and regulations.

The Chairperson of the Annual Meeting may refuse to allow the presentation of a proposal or nominee for the Board of Directors if the proposal or nominee is not properly submitted. The requirements for submitting proposals and nominations for this year’s Annual Meeting are detailed in Fluent’s By-Laws as well as our definitive proxy statement for our 2022 annual meeting of stockholders filed with the SEC on May 2, 2022.

WEBSITES

Website addresses referenced in this proxy statement are provided for convenience only, and the content on the referenced websites does not constitute a part of this proxy statement.

QUESTIONS AND ANSWERS ABOUT THIS PROXY STATEMENT AND VOTING

WHAT IS THE PURPOSE OF THE MEETING?

At the Meeting, stockholders will act upon the proposals described in this proxy statement. In addition, following the formal portion of the Meeting, management will be available to respond to questions from stockholders.

WHAT IS INCLUDED IN THE PROXY MATERIALS?

These materials include, the proxy statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 as filed with the SEC on March 15, 2023.

WHAT PROPOSALS ARE SCHEDULED TO BE VOTED ON AT THE MEETING?

Stockholders will be asked to vote on the following three proposals at the Meeting:

COULD MATTERS OTHER THAN PROPOSALS ONE, TWO AND THREE BE DECIDED AT THE MEETING?

Our Bylaws require that we receive advance notice of any proposal to be brought before the Meeting by stockholders, and we have not received notice of any such proposals. If any other matter were to come before the Annual Meeting, the proxies will have the discretion to vote on those matters for you.

DO THE COMPANY’S OFFICERS AND DIRECTORS HAVE AN INTEREST IN ANY OF THE MATTERS TO BE ACTED UPON AT THE ANNUAL MEETING?

Our directors have an interest in Proposal 1 (election of directors) and our named executive officers have an interest in Proposal 2 (Say-on-Pay). Our directors and executive officers do not have any interest in Proposal 3 (ratification of the appointment of our auditor).

This proxy statement and our 2022 Annual Report on Form 10-K are also available on Fluent’s Internet website at www.fluentco.com

HOW DOES THE BOARD OF DIRECTORS RECOMMEND I VOTE ON THESE PROPOSALS?

Our Board of Directors recommends that you vote your shares:

“FOR” all the director nominees (Proposal One);

“FOR” the approval, on an advisory basis, of the 2022 compensation of our named executive officers (Proposal Two); and

“FOR” the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal Three).

HOW DO I ATTEND THE ANNUAL MEETING?

The Annual Meeting will be held on Wednesday June 7, 2023 at 11:00 a.m. Eastern Time virtually at www.virtualshareholdermeeting.com/FLNT2023.

WHO IS ENTITLED TO VOTE?

Only stockholders of record as of the close of business on May 5, 2023 will be entitled to notice of, and to vote at, the 2023 Annual Meeting. A list of stockholders eligible to vote at the 2023 Annual Meeting is available for inspection at any time up to the 2023 Annual Meeting. If you would like to inspect the list, please call Daniel J. Barsky, General Counsel and Corporate Secretary, at (646) 669-7272 to arrange a visit to our offices.

HOW DO I VOTE?below.

If you are thea stockholder of record, holder of your shares, you can vote four ways:

|

|

|

|

|

|

|

|

|

|

Timing is important, so please mail your proxy card promptly. We must receive it before the beginning of the Annual Meeting. If you do not give voting instructions on your signed and mailed proxy card, the named proxies will vote your shares “FOR” each of the director nominees, and “FOR” Proposals 2 and 3. If any other matters requiring a vote arise during the Annual Meeting, the named proxies will exercise their discretion using their best judgment to the extent permitted by applicable law and Nasdaq and SEC rules and regulations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOW DO I REVOKE MY PROXY OR CHANGE MY VOTING INSTRUCTIONS?

You may revoke your proxy at any time before the proxy is exercisedfinal vote at the Annual Meeting by:

|

|

|

|

● | delivering a properly completed proxy card with a later date, or vote by telephone or on the Internet at a later date (we will vote your shares as directed in the last instructions properly received from you prior to the Meeting); or |

|

|

HOW WILL PROXIES BE VOTED IF I GIVE MY AUTHORIZATION?If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank or other agent that is the holder of record and following its instructions.

If you (i) properly executePlease note that to be effective, your new proxy card, internet or telephonic voting instructions or written notice of revocation must be received by the Secretary prior to the Meeting and, return it to Fluent,in the case of internet or (ii) submit yourtelephonic voting instructions, must be received before 11:59 p.m. Eastern Time on March 17, 2024.

Unless revoked, a proxy by telephone or via the Internet and do not subsequently revoke your proxy, your shares of common stock will be voted at the Annual Meeting according to yourvirtual meeting in accordance with the stockholder’s indicated instructions.

In the absence

What if I return a signed proxy card or otherwise submit a valid proxy but do not make specific voting choices?

If you are a stockholder of record and submit a proxy without making any voting instructions, the named proxies will voteselections, your shares will be voted “FOR” each of the director nominees and “FOR” Proposals 2 and 3. If other matters properly come beforeproposals described in this proxy statement in accordance with the Annual Meeting,recommendations of the named proxies will vote on such matters using their best judgment to the extent permitted by applicable law and Nasdaq and SEC rules and regulations.

WHAT IF MY SHARES ARE NOT REGISTERED IN MY NAME?Board.

If you are a beneficial owner, please see the Fluent stockdiscussion above regarding uninstructed shares under the heading “What happens if I do not vote?”.

What if I have questions about my shares or need to change my mailing address?

If you own is held in the nameare a stockholder of a bank, broker, or other nominee (commonly referred to as holding shares in “street name”), your bank, broker, or other nominee shouldrecord and have provided you access to these proxy materials by mail or e-mail with information on how to submit your voting instructions. Unless you provide voting instructions to your bank, broker, or other nominee,questions about your shares will not be voted on Proposal 1 (the election of directors) and Proposal 2 (say-on-pay), both of which are “non-routine” proposals. In contrast, brokers may, at their discretion, vote uninstructed shares on Proposal 3 (auditor ratification), which is a “routine” proposal. Broker non-votes count toward a quorum, but otherwise do not affect the outcome of any proposal.

WHAT IF I HAVE QUESTIONS ABOUT MY SHARES OR NEED TO CHANGE MY MAILING ADDRESS?

Youor need to change your mailing address, you may contact our transfer agent, Continental Stock Transfer and& Trust Company, by telephone at (212) 509-4000 or (800) 509-5586, through its website at https://continentalstock.com/contact, or by U.S. mail at 1 State Street, 30th Floor, New York, NY 10004, if you have questions about your shares or need to change your mailing address.10004.

HOW WILL VOTES, ABSTENTIONS, AND BROKER NON-VOTES BE COUNTED?If you are a beneficial owner, please contact the broker, bank or other nominee holding your shares.

TheWhat is the quorum requirement for the Meeting?

A quorum of stockholders is necessary to hold the Meeting. A quorum will be present if a majority of the outstanding shares of our common stock entitled to vote on the record date are present in person or represented by proxy at the Meeting. On the record date, there were [•] shares of our common stock outstanding and entitled to vote. Thus, at least [•] shares must be present or represented by proxy at the Meeting in order for there to be a quorum. Abstentions and broker non-votes will be counted as present for purposes of determining a quorum.

If a quorum is not present at the time appointed for the Meeting or within a reasonable time thereafter as the stockholders may determine, the stockholders present or represented at the Meeting may adjourn the Meeting to another time and place.

Who will count the votes?

Votes will be counted by the inspector of election appointed for the Annual MeetingMeeting. The inspector of election will determine whether a quorum is present and will tabulate votes cast for each proposal by proxy and at the Board of Directors will separately tabulate affirmative and negative votes, abstentions, and broker non-votes. Shares represented by proxies that reflect abstentions and broker non-votes are counted for determining whether there is a quorum.meeting.

How many votes are required to approve each proposal?

With respect toApproval of each of the Reverse Stock Split Proposal 1,and the Adjournment Proposal requires that a nominee for director will be elected toquorum is present at the Board ifMeeting and a majority of the votes cast for such nominee’s electionon the proposal are cast affirmatively. In other words, to be approved, the votes cast “FOR” the proposal must exceed the votes cast against such nominee’s election. Approval of Proposals 2 and 3 requires“AGAINST” the affirmative vote of a majority of votes cast at the Annual Meeting by the holders entitled to vote thereon. For Proposal 1, abstentions and broker non-votes will not be considered in determining whether director nominees have received more “for” votes than “against” votes. proposal.

Abstentions and broker non-votes, if any, will be counted for purposes of calculating whether a quorum is present at the Meeting, but are not considered to be votes cast for the foregoing purposeon any proposal and, therefore, dobroker non-votes and abstentions will have no effect on the outcome of the Reverse Stock Split Proposal or the Adjournment Proposal. Broker non-votes are not affect Proposal 2. Abstentions do not affect Proposal 3.expected on either of the proposals because each proposal is expected to be considered a “routine” matter.

WHAT DOES IT MEAN IF

What does it mean if I RECEIVE MORE THAN ONE NOTICE?receive more than one proxy card?

If you receive more than one set of proxy materials or more than one proxy card or voting instruction form, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions foron each set of the proxy materialscards and/or voting instruction forms you receive to ensure that all of your shares are voted.

IS MY VOTE CONFIDENTIAL?Am I entitled to dissenter rights or appraisal rights?

No, our stockholders are not entitled to dissenters’ rights or appraisal rights on any of the matters being submitted to stockholders at the Meeting.

Can I access this proxy statement on the Internet?

Yes, this proxy statement is available on our website at https://investors.fluentco.com/financial-information/sec-filings. Instead of receiving future proxy statements and accompanying materials by mail, most stockholders can elect to receive an e-mail that will provide electronic links to them. Opting to receive your vote is confidential. Onlyproxy materials online will save us the inspectorcost of elections, individuals who help with processingproducing documents and counting your votesmailing them to you, and persons who need access for legal reasons will have accessalso gives you an electronic link to your vote. This information will not be disclosed, except as required by law.the proxy voting site.

WHAT CONSTITUTES A QUORUM?Stockholders of Record: You may enroll in the electronic proxy delivery service at any time by accessing your stockholder account at https://continentalstock.com and following the enrollment instructions.

To carry on business atBeneficial Owners: You also may be able to receive copies of these documents electronically. Please check the Annual Meeting, we must have a quorum. A quorum is present when a majority ofinformation provided in the shares entitledproxy materials sent to vote as of the record date, are represented in person or by proxy. Thus, approximately 40,518,082 shares must be represented in person or by proxy to have a quorum at the Annual Meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person atnominee regarding the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. Shares owned by us are not considered outstanding or considered to be present at the Annual Meeting. If there is not a quorum at the Annual Meeting, the stockholders present or represented at the Annual Meeting may adjourn the Annual Meeting.availability of this service.

WHO IS PAYING FOR THE EXPENSES INVOLVED IN PREPARING AND MAILING THIS PROXY STATEMENT?Who will pay for the cost of this proxy solicitation?

All ofWe will pay the expenses involved in preparing, assembling and mailing these proxy materials and all costscost of soliciting proxies will be paid by us. In addition to the solicitation by mail, proxiesproxies. Proxies may be solicited on our behalf by our directors, officers or employees in person or by telephone, electronic transmission and facsimile transmission or by other means of communication. Our directors, officers or employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other employees by telephone or in person. Such persons will receive no compensationagents for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitationthe cost of forwarding proxy materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in forwarding solicitation materials.owners. We do not anticipate hiring an agency to solicit votes from stockholders at this time; however, if we determine that such action would be appropriate or necessary, we would pay the cost of such service.

DOHow can I HAVE DISSENTERS’ RIGHTS OF APPRAISAL?

Our stockholders do not have appraisal rights under Delaware law or under our governing documents with respect tofind out the matters to be voted uponresults of the voting at the Annual Meeting.

HOW DO I SUBMIT QUESTIONS DURING THE MEETING?

Stockholders may submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/FLNT2023 and using their 16-digit control number to enter the meeting. Questions may be submitted by typing them into the text box provided.

WHO WILL TABULATE THE VOTES?

A representative of the Company will serve as the Inspector of Elections and will tabulate the votes at the Annual Meeting.

HOW CAN I FIND OUT THE RESULTS OF THE VOTING AT THE ANNUAL MEETING?Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, finalFinal voting results will be disclosedreported in a Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) that we expect to file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K with the SEC within four business days after the Annual Meeting, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amendment to the original Current Report on Form 8-K to publish the final results.

ELECTION OF DIRECTORSWho can help answer questions I might have about the Meeting, including if I have any questions about how to vote?

AtIf you have any questions concerning the virtual Meeting we will be electing seven directors. Each director will hold office until(including accessing the 2024 Annual Meetingmeeting by virtual means) or would like additional copies of Stockholders or until a successor is elected and qualified to serve on the Board or until such director’s earlier death, resignation or removal. Proxies cannot be voted for a greater number of persons than the number of nominees named.

The Board has nominated the seven individuals listed below (each a “Nominee,” and together the “Nominees”) based on the recommendation of the Board’s Corporate Governance and Nominating Committee. All of the Nominees are current directors. Each Nominee has consented to being named in this proxy statement and has agreed to serve as a director if elected. If any Nominee should become unavailable for election, the proxy may be voted for a substitute nominee selected by the persons named in the proxy or the Board may determine to reduce the size of the Board accordingly. The Board is not aware of any existing circumstances likely to render any Nominee unavailable.

| |||||

|

| ||||

|

|

| |||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

|

| |||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

| |||||

|

| ||||

|

|

| |||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

Family Relationships

There are no family relationships among any of our executive officers or directors.

Involvement in Certain Legal Proceedings

We are not aware of any of our directors or officers being involved in any legal proceedings in the past ten years required to be disclosed pursuant to Item 401(f) of Regulation S-K.

There have been no material proceedings to which any director, executive officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or any associate of any such director, executive officer, affiliate of the Company, or security holder is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

Arrangements with Officers and Directors

There are no arrangements or understandings with another person pursuant to which any of our executive officers or directors were selected as an executive officer or director.

Vote Required and Board Recommendation

Under our By-Laws, a nominee for director will be elected to the Board if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election; abstentions and broker non-votes are not counted as a vote cast either “for” or “against” that nominee’s election and therefore have no effect.

The Board approved and adopted a Director Resignation Policy on February 13, 2019 for directors who fail to receive the required number of votes in an uncontested election in accordance with our By-Laws. The policy requires that the Board will nominate for election or re-election only a candidate who agrees to tender an irrevocable resignation that will be effective upon (i) the failure to receive the required vote at any future annual meeting at which he or she faces re-election; and (ii) Board acceptance of such resignation. The policy further states that upon any candidate failing to be elected in an election at which majority voting applies, the Corporate Governance and Nominating Committee will meet to consider the tendered resignation and make a recommendation to the Board concerning the action, if any, to be taken with respect to the resignation. The policy provides that the Board will then consider and act upon the Corporate Governance and Nominating Committee’s recommendation within 90 days of certification of the vote at the annual meeting. The Board may accept the resignation, refuse the resignation, or refuse the resignation subject to such conditions designed to cure the underlying cause as the Board may impose. Promptly following the decision regarding the tendered resignation, the policy states that the Company will file with the SEC a Current Report on Form 8-K disclosing the decision with respect to the resignation, describing the deliberative process and, if applicable, the specific reasons for rejecting the tendered resignation.

Board Diversity Matrix

The Corporate Governance and Nominating Committee is committed to continuing to identify and recruit highly qualified candidates with diverse experiences, perspectives, and backgrounds to join our Board. We have surveyed our current directors and asked each director to self-identify their race, ethnicity, and gender using one or more of the below categories. The results of this survey are included in the matrix below. Each of the categories listed in the table below has the meaning as it is used in Nasdaq Rule 5605(f).

Board Diversity Matrix for Fluent, Inc.

As of March 31, 2023 | ||||

Total Number of Directors: | 7 | |||

Part I: Gender Identity | ||||

Female | Male | Non-Binary | Did Not Disclose Gender | |

Directors | 2 | 5 | ||

Part II: Demographic Background | ||||

African American | 1 | |||

Alaskan Native or American Indian | ||||

Asian | ||||

Hispanic or Latinx | ||||

Native Hawaiian or Pacific Islander | ||||

White | 2 | 4 | ||

Two or More Races or Ethnicities | ||||

LGBTQ+ | ||||

Did Not Disclose Demographic Background | ||||

Board Diversity Matrix for Fluent, Inc.

As of June 28, 2022 | ||||

Total Number of Directors: | 5 | |||

Part I: Gender Identity | ||||

Female | Male | Non-Binary | Did Not Disclose Gender | |

Directors | 2 | 3 | ||

Part II: Demographic Background | ||||

African American |

| |||

Alaskan Native or American Indian | ||||

Asian | ||||

Hispanic or Latinx | ||||

Native Hawaiian or Pacific Islander | ||||

White | 2 | 3 | ||

Two or More Races or Ethnicities | ||||

LGBTQ+ | ||||

Did Not Disclose Demographic Background | ||||

Board Recommendation

The Board unanimously recommends a vote “FOR” each Nominee for director.

On April 19, 2018, the Compensation Committee adopted general director compensation practices, which was subsequently amended on February 16, 2021, pursuant to which a non-employee director joining the Board is granted 60,000 restricted stock units (“RSUs”). The RSUs vest in three equal annual installments beginning on the first anniversary of the grant date. Additionally, non-employee directors are paid $10,000 quarterly, plus annual fees of $10,000 for the Chair of the Audit Committee and $5,000 to the Chair of each of the Compensation Committee and the Corporate Governance and Nominating Committee. The Compensation Committee recommended that the Lead Independent Director receive an annual fee of $5,000. Additionally, on the date of each annual meeting, non-employee directors are granted such number of RSUs representingyour shares of the Company’s common stock, with a grant date value equal to $75,000. The RSUs vest in three equal annual installments beginning on the first anniversary of the grant date, subject to accelerated vesting in certain circumstances. The number of RSUs is determined using the average closing price of our common stock for the five trading days before the date of the annual meeting.

The following table provides compensation information for the fiscal year ended December 31, 2022 for each of our non-employee directors.

Name | Fees earned or paid in cash ($) | Stock awards ($) (1)(7) | Option awards ($) | Non-equity incentive plan compensation ($) | Nonqualified deferred compensation earnings ($) | All other compensation ($) | Total ($) | |||||||||||||||||||||

Donald Mathis (2) | 47,500 | 82,876 | — | — | — | — | 130,376 | |||||||||||||||||||||

Carla S. Newell (3) | 45,000 | 82,876 | — | — | — | — | 127,876 | |||||||||||||||||||||

Barbara Shattuck Kohn (4) | 50,000 | 82,876 | — | — | — | — | 132,876 | |||||||||||||||||||||

David Graff (5) | 11,250 | 84,600 | — | — | — | — | 95,850 | |||||||||||||||||||||

Richard Pfenniger (6) | 11,250 | 84,600 | — | — | — | — | 95,850 | |||||||||||||||||||||

|

| |

|

| |

|

| |

|

| |

|

|

Board Meetings; Annual Meeting Attendance; Independence

The Board oversees our business and affairs and monitors the performance of management. The Board meets regularly to review matters affecting our Company and to act on matters requiring Board approval. The Board also holds special meetings whenever circumstances require and may act by unanimous written consent. During 2022, the Board held eight meetings and took action by unanimous written consent on two occasions. During 2022, all of our incumbent directors attended at least 75% of the aggregate meetings of the Board and its committees on which they served during the period of time that each such director was a member of the Board. The Board encourages, but does not require, its directors to attend the Company’s annual meeting. All of our then-current directors virtually attended our 2022 Annual Meeting of Stockholders.

As required by the listing standards of Nasdaq, a majority of the members of the Board must qualify as “independent,” as affirmatively determined by the Board. Our Board determines director independence based on an analysis of such listing standards and all relevant securities and other laws and regulations regarding the definition of “independent.”

As a result of the Board’s review of the relationships of each of the directors that served on the Board during the year ended December 31, 2022, the Board affirmatively determined that Messrs. Mathis, Graff and Pfinneger and Mses. Newell and Shattuck Kohn were “independent” directors within the meaning of the Nasdaq listing standards and applicable law. In addition, the Board of Directors has also determined that each member of the Audit Committee meets the additional criteria for independence of Audit Committee members under Rule 10A-3(b)(1) of the Securities Exchange Act of 1934, as amended (the "Exchange Act").

Board Oversight of Enterprise Risk

The Board’s role in the risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal, and regulatory, cybersecurity and strategic and reputational risks. In connection with its reviews of the operations of the Company’s business and its corporate functions, the Board considers and addresses the primary risks associated with these operations and functions. Our full Board regularly engages in discussions of the most significant risks that the Company is facing and how these risks are being managed.

In addition, each of the Board’s committees, and particularly the Audit Committee, plays a key role in overseeing risk management issues that fall within such committee’s areas of responsibility. Senior management reports on at least a quarterly basis to the Audit Committee on the most significant risks facing the Company from a financial reporting perspective and highlights any new risks that may have arisen since the Audit Committee last met. The Audit Committee also meets in executive sessions with the Company’s independent registered public accounting firm and reports any findings or issues to the full Board. In performing its functions, the Audit Committee and each standing committee of the Board has full access to management, as well as the ability to engage advisors. The Board receives regular reports from each of its standing committees regarding each committee’s particularized areas of focus.

Committees

The standing committees of the Board are the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee. In addition to regularly scheduled meetings, the committees also took certain actions taken by unanimous written consent. Written charters for each committee are available on the Company’s website at https://investors.fluentco.com/corporate-information/corporate-governance. The Board maintains one ad-hoc committee, the Risk and Compliance Committee to oversee certain specified risk and compliance issues.

| |

| |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director Nominations Process

Our Corporate Governance and Nominating Committee is responsible for recommending candidates to serve on the Board and its committees. In considering whether to recommend any particular candidate to serve on the Board or its committees or for inclusion in the Board’s slate of recommended director nominees for election at the annual meeting of stockholders, the Corporate Governance and Nominating Committee considers the criteria set forth in the Corporate Governance and Nominating Committee charter. Specifically, the Corporate Governance and Nominating Committee may take into account many factors, including, but not limited to, personal and professional integrity, experience relevant to the Company’s industry, diversity of background and experience including, but not limited to, with respect to gender and ethnicity and any other relevant qualifications, attributes or skills.

Board Diversity Policies

We consider diversity a meaningful factor in identifying director nominees, but do not have a formal diversity policy. The Board evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure. In determining whether to recommend a director for re-election, the Corporate Governance and Nominating Committee may also consider potential conflicts of interest with the candidates, other personal and professional pursuits, the director’s past attendance at meetings and participation in and contributions to the activities of the Board.

In identifying prospective director candidates, the Corporate Governance and Nominating Committee may seek referrals from other members of the Board or stockholders. The Corporate Governance and Nominating Committee also may, but need not, retain a third-party search firm in order to assist it in identifying candidates to serve as directors of the Company. The Corporate Governance and Nominating Committee uses the same criteria for evaluating candidates regardless of the source of the referral or recommendation. When considering director candidates, the Corporate Governance and Nominating Committee seeks individuals with backgrounds and qualities that, when combined with those of our incumbent directors, provide a blend of skills and experience to further enhance the Board’s effectiveness.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics, which is applicable to the Company’s directors, officers, and employees, including the Company’s principal executive officer and principal financial officer. The Code of Ethics is published on the Company’s website at www.fluentco.com on the Investors Relations page under the Corporate Information, Corporate Governance link. We will disclose amendments to or waivers from our Code of Ethics on our website in accordance with all applicable laws and regulations.

Anti-hedging

As part of our Insider Trading Policy, all of our officers, directors, employees and consultants and family members or others sharing a household with any of the foregoing or who live elsewhere but whose transactions in our securities are directed by such employees, officers and directors or subject to their influence and control are prohibited from engaging in short sales of our securities, any hedging or monetization transactions involving our securities and in transactions involving puts, calls or other derivative securities based on our securities. Our Insider Trading Policy further prohibits employees, officers, directors and consultants from purchasing our securities on margin or pledging our securities as collateral for a loan. As of December 31, 2022, none of our directors or executive officers had pledged any shares of our common stock.

Board Leadership Structure

On July 1, 2021, Donald Patrick who had been our Chief Operating Officer became our Interim Chief Executive Officer and Ryan Schulke, our co-founder and former Chief Executive Officer, became our Chief Strategy Officer and Chairman of the Board. Mr. Patrick, who is not a director, became Chief Executive Officer on January 12, 2022.

Effective June 28, 2022, Donald Mathis, an independent Director, was appointed to act as the Lead Independent Director (the "Lead Director") by the independent members of the Board. By appointing a Lead Director independent of management, our Chief Executive Officer and Chair can focus on our day-to-day business while our Lead Director can play an oversight role with respect to the Board and decisions regarding corporate strategy, management succession, performance and compensation, audit and internal controls, Board composition and functions, and accountability to shareholders. The Lead Director chairs the executive sessions of the independent directors. Our Chief Executive Officer is the public spokesperson for the Company and communicates with investors and the public and leads our quarterly earnings calls. He also plays a critical role in setting the agenda for the Board and for keeping the Board informed between meetings. Our Board believes this division of duties and the separation of management from the Board is appropriate, as it enhances the accountability of the Chief Executive Officer to the Board and strengthens the independence of the Board of Directors from management.

Communications with our Board of Directors

Any stockholder who wishes to send a communication to our Board should address the communication either to the Board or to the individual director in care ofplease contact Daniel J. Barsky, General Counsel and Corporate Secretary, of Fluent, Inc.,by telephone at (646) 669-7272 or by mail at 300 Vesey Street, 9th Floor, New York, New York 10282. Mr. Barsky will forward the communication either to all of the directors, if the communication is addressed to the Board, or to the individual director, if the communication is addressed to a specific director. Mr. Barsky will forward to the directors all communications that, in his judgment, are appropriate for consideration by the directors. Examples of communications that would not be appropriate for consideration by the directors include commercial solicitations and matters not relevant to the stockholders, to the functioning of the Board, or to the affairs of Fluent.

Nominees for Director and Other Stockholder Proposals for the 2024 Annual Meeting of StockholdersPROPOSAL NO. 1

THE REVERSE STOCK SPLIT PROPOSAL

Proposals for Inclusion in the 2024 Proxy

From time to time, stockholders present proposals that may be proper subjects for inclusion in the proxy statement and for consideration at an annual meeting. Under SEC rules, in order to be included in the proxy statement for the 2024 Annual Meeting of Stockholders, stockholder proposals submitted under Rule 14a-8 of the Exchange Act, must be received by our Corporate Secretary at 300 Vesey Street, 9th Floor, New York, New York 10282 not later than January 10, 2024. In the event the date of the 2024 Annual Meeting of Stockholders has been changed by more than 30 days from the date of the 2023 Annual Meeting, stockholders who intend to have a proposal considered for inclusion in our proxy materials for presentation at our 2024 Annual Meeting of Stockholders must submit the proposal to us at our office no later than a reasonable time before we begin to print and send our proxy materials for our 2024 Annual Meeting of Stockholders.

Other Proposals and NominationsGeneral

Our By-Laws requireBoard has adopted and is recommending that a stockholder who otherwise intends to: (i) present a proposal outside of Rule 14a-8 under the Exchange Act; or (ii) nominate a director for our 2024 Annual Meeting of Stockholders, must deliver noticestockholders approve an amendment to our Corporate Secretary, in proper written formcertificate of incorporation, as amended, to effect a reverse split of the issued shares of our common stock at a ratio that is not less than 1-for-2 and in accordancenot greater than 1-for-15, without reducing the authorized number of shares of our common stock, with the requirementsexact ratio to be selected by the Board in its discretion, and to be effected, if at all, in the sole discretion of the By-Laws, on orBoard at any time after February 8, 2024 but no later than March 9, 2024; provided, however, in the event that the datestockholder approval of the 2024 Annual Meetingamendment and before March 18, 2025 without further approval or authorization of Stockholdersour stockholders. If our stockholders approve this proposal, the Board will have authority to give effect to the reverse stock split. However, notwithstanding stockholder approval of this proposal, the Board may elect not to proceed with the reverse stock split if, at any time the Board, in its sole discretion, determines that it is more than 30 days before or more than 70 days afterno longer in our best interest and the anniversary datebest interests of our stockholders to proceed with the reverse stock split. By voting in favor of this proposal, you are expressly also authorizing the Board to determine not to proceed with the reverse stock split in its sole discretion.

If the reverse stock split is implemented, at the effective time of the 2023 Annual Meeting, notice byreverse split, the stockholder must be delivered not earlier than the closeissued shares of business on the 120th dayour common stock immediately prior to the dateeffective time will be combined and reclassified into a smaller number of shares such that, except for adjustments that may result from the 2024 Annual Meetingtreatment of Stockholder and not later than the closefractional shares as described below, each of business on the laterour stockholders will own one new share of (i) the 90th dayour common stock for every two to 15 shares of common stock owned by such stockholder immediately prior to the dateeffective time of the reverse split, depending on the exact ratio approved by the Board.

A copy of the proposed form of certificate of amendment to our certificate of incorporation to effect the reverse stock split is attached as Appendix A to this proxy statement.

Reasons for the Reverse Stock Split; Potential Consequences of the Reverse Stock Split

Our primary reason for recommending the reverse stock split is based on our belief that the reverse stock split will likely be necessary to increase the bid price of our common stock within the Additional Compliance Period (as defined below) to avoid being delisted from The Nasdaq Capital Market. Our common stock is publicly traded and listed on The Nasdaq Capital Market under the trading symbol “FLNT.” To maintain our listing, we must comply with the continued listing requirements of The Nasdaq Capital Market, which include a minimum bid price requirement of $1.00 per share.

On May 1, 2023, we received a letter from The Nasdaq Stock Market LLC (“Nasdaq”) indicating that we no longer met the minimum bid price requirement set forth in Nasdaq Listing Rule 5450(a)(1) because the closing bid price for our common stock was less than $1.00 per share for the previous 30 consecutive business days. In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we were provided an initial period of 180 calendar days, or until October 30, 2023 (the “Initial Compliance Period”), to regain compliance with the minimum bid price requirement set forth in Nasdaq Listing Rule 5450(a)(1). On October 5, 2023, we applied to transfer the listing of our common stock from The Nasdaq Global Market to The Nasdaq Capital Market (the “Transfer”). On October 16, 2023, we received notice from the Nasdaq Listing Qualifications Staff (the “Nasdaq staff”) that the Transfer was approved. The Transfer became effective on October 18, 2023, at which time we were afforded the remainder of the Initial Compliance Period.

On October 31, 2023, we received notification that the Nasdaq staff determined we were eligible for an additional 180 calendar day period, or until April 29, 2024 Annual Meeting(the “Additional Compliance Period”), to regain compliance with the minimum $1.00 per share bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”). We were afforded the Additional Compliance Period under Nasdaq Listing Rule 5810(c)(3)(A)(ii) based on the Company meeting the continued listing requirement for market value of Stockholder or (ii)publicly held shares and all other applicable requirements for initial listing on The Nasdaq Capital Market, with the 10th day followingexception of the day on which public announcementMinimum Bid Price Requirement, and our written notice to Nasdaq of our intention to cure the Minimum Bid Price Requirement deficiency during the Additional Compliance Period by effecting a reverse stock split, if necessary.

If at any time during the Additional Compliance Period, the closing bid price of our common stock is at least $1.00 per share for a minimum of ten consecutive business days, the Nasdaq staff will provide written confirmation of compliance with the Minimum Bid Price Requirement and the matter will be closed, unless the Nasdaq staff exercises its discretion to require the Company to satisfy the Minimum Bid Price Requirement for a period in excess of ten consecutive business days as described in Nasdaq Listing Rule 5810(c)(3)(H). If we do not demonstrate compliance with the Minimum Bid Price Requirement by April 29, 2024, we will receive written notification from the Nasdaq staff that our common stock will be delisted. At that time, we may appeal the delisting determination to an independent hearings panel by submitting a hearing request within seven calendar days of the date of the 2024 Annual Meeting of Stockholder is first made by us.

In order for stockholders to givedelisting determination notice. If timely notice of nominations for directors for inclusion on a universal proxy card in connection withrequested, we expect the 2024 Annual Meeting, notice must be submitted by the same deadline as disclosed above under the advance notice provisions of our Bylaws and such notice must include all the information required by Rule 14a-19(b) under the Exchange Act and such stockholders must comply with allhearing would take place within 45 days of the requirementshearing request. A timely request for a hearing will ordinarily stay Nasdaq’s suspension and delisting action pending the issuance of Rule 14a-19 undera written panel decision. However, there would be no assurance that, if we receive a delisting notice and appeal the Exchange Act.

Stockholders are also advised to review our By-laws, which contain additional requirements relating to stockholder proposals and director nominations, including who may submit them and what information mustdelisting determination, such appeal would be included.

We reserve the right to reject, rule out of order or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

NON-BINDINGADVISORY VOTE

“SAY-ON-PAY”

The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in July 2010, and Section 14A of the Exchange Act, require that we provide our stockholders with the opportunity to vote to approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement. At the Meeting, the Company will present its Say-on-Pay proposal for approval.

This Say-on-Pay proposal is set forth in the following resolution:

RESOLVED, that the stockholders of Fluent, Inc. approve, on an advisory basis, the compensation of its named executive officers, as disclosed in the Fluent, Inc. proxy statement for the 2023 Annual Meeting of Stockholders, pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the information included in the Executive Compensation, the summary compensation table and other related tables and disclosure found in the proxy statement of Fluent, Inc.

Because your vote on this proposal is advisory, it will not be binding on us. However, we will take into account the outcome of the vote when considering future executive compensation arrangements.

The Role of Stockholder Say-on-Pay Votessuccessful.

The Board Compensation Committee,has considered the potential harm to the Company and management valueour stockholders should Nasdaq delist our common stock from The Nasdaq Capital Market. Delisting our common stock could adversely affect the opinionsliquidity and market price of our stockholders. We providecommon stock because alternatives, such as the OTCQB and the Pink markets operated by the OTC Markets Group Inc., are generally considered to be less efficient markets. An investor likely would find it less convenient to sell, or to obtain accurate quotations in seeking to buy our stockholderscommon stock on such markets. Many investors likely would not buy or sell our common stock due to difficulty in accessing the OTCQB or Pink markets, policies preventing them from trading in securities not listed on a national securities exchange, or other reasons. Delisting of our common stock from The Nasdaq Capital Market could also cause a loss of confidence of existing or potential industry partners, clients, lenders, and employees, which could further harm our business and our future prospects. The Board believes that the reverse stock split is a potentially effective means for us to regain compliance with the opportunityMinimum Bid Price Requirement by producing the immediate effect of increasing the per share bid price of our common stock to cast an advisory voteavoid, or at least mitigate, the likely adverse consequences of our common stock being delisted from The Nasdaq Capital Market.

In addition, the reverse stock split may make our common stock a more attractive and cost-effective investment to approve named executive officer compensation, including compensationa broader range of investors, which in turn could improve the marketability and liquidity of our common stock. For example, the current market price of our common stock may prevent certain institutional investors, professional investors and other members of the investing public from purchasing our common stock. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Furthermore, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of our common stock can result in investors paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were higher.

Reducing the number of outstanding shares of our common stock through the reverse stock split is intended, absent other factors, to increase the per share bid price of our common stock. However, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the bid price of our common stock. As a result, there can be no assurance that the reverse stock split, if completed, will result in the intended or expected benefits described above, that the bid price of our common stock will increase following the reverse stock split, that as a result of the reverse stock split we will be able to satisfy the Minimum Bid Price Requirement, or that the bid price of our common stock will not decrease in the future. Additionally, we cannot assure you that the bid price per share of our common stock after the reverse stock split will increase in proportion to the reduction in the number of shares of our common stock outstanding before the reverse stock split. Accordingly, the total market capitalization of our common stock after the reverse stock split may be paidlower than the total market capitalization before the reverse stock split, and a reduction in connection with a change in control or a termination. At our annual meetingnumber of stockholders held in June 2022, approximately 87.4% ofshares outstanding may impair the stockholders who voted on the Say-on-Pay proposal voted in favor of the compensation of our named executive officers as disclosed in our 2022 proxy statement. Although the advisory Say-On-Pay vote is non-binding, our Compensation Committee considered the outcome of the vote and determined not to make material changes to our executive compensation programs because the Compensation Committee believed this advisory vote indicated considerable stockholder supportliquidity for our approach to executive compensation. Our Compensation Committee will continue to consider the outcome of our Say-on-Pay votes when making future compensation decisions for our named executive officers.

Vote Required and Board Recommendation

The advisory vote on the Say-on-Pay proposal requires the affirmative vote of the holders of a majority in voting power of the shares of common stock, which are present in person or by proxy atmay reduce the Meeting and entitled to vote.

The Board unanimously recommends a vote “FOR” the Say-on-Pay proposal.

RATIFICATION OF THE APPOINTMENT OF GRANT THORNTON LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2023

Grant Thornton LLP (“Grant Thornton”) currently serves as the Company’s independent registered public accounting firm and has done so since its appointment effective July 14, 2015. A representative of Grant Thornton is expected to be present at the Meeting, with the opportunity to make a statement if the representative desires to do so and is expected to be available to respond to appropriate questions.

We are asking our stockholders to ratify the appointment of Grant Thornton as our independent registered public accounting firm for the year ending December 31, 2023. Although ratification is not required by our By-Laws or otherwise, our Board is submitting the appointment of Grant Thornton to our stockholders for ratification as a matter of good corporate governance. If our stockholders fail to ratify the appointment of Grant Thornton, the Audit Committee will consider whether it is appropriate and advisable to appoint a different independent registered public accounting firm. Even if our stockholders ratify the appointment of Grant Thornton, the Audit Committee in its discretion may appoint a different registered public accounting firm at any time if it determines that such a change would be in the best interestsvalue of our Company and our stockholders.

Auditor Fees and Services

The following table sets forth the fees billed to the Company by the Company’s independent registered public accountants, Grant Thornton, for the years ended December 31, 2022 and December 31, 2021.

2022 | 2021 | |||||||

Audit Fees (1) | $ | 777,908 | $ | 857,000 | ||||

Audit-Related Fees (2) | — | — | ||||||

Tax Fees (3) | — | — | ||||||

All Other Fees (4) | — | — | ||||||

Total | $ | 777,908 | $ | 857,000 | ||||

(1) Audit fees consist of fees billed for professional services rendered for the audit of our consolidated annual financial statements, and internal control over financial reporting, the review of the interim consolidated financial statements included in quarterly reports and the fees for services such as consents, and review of documents filed with the SEC that are normally provided in connection with statutory and regulatory filings for engagements.